Press Release: InsurTech NY Announces its 2020 Accelerator Cohort

This article was published in October 2020. For current news on our Accelerator program, click here.

NEW YORK, Oct. 13, 2020 /PRNewswire/ — InsurTech NY, the largest InsurTech community in the New York metro area, announced today its growth-stage InsurTech accelerator new york cohort.

22 startups were selected to participate in its insurance carrier and broker sponsored program that focuses on providing resources to support traction, talent, and financing. The program will provide access to insurance carriers and brokers looking to deploy new technologies and provide financial backing to digital managing general agencies (MGAs).

“Our member carriers and brokers worked closely with us to hand-select startups that align with their organizational goals,” said David Gritz, InsurTech NY Managing Director. “The goal of the program is to help startups accelerate the process of building long-term strategic relationships and gain knowledge on the best way to do so.”

Selected startups include:

Life and Annuities Lines: Amenity Analytics, Best Fit, Breathe Life, Everyday Life, Fenris, Gerald App, Insurmi, IXN, Sensely, Sorcero, and Vymo

Property and Casualty Lines: Assurely, Dealer Policy, Ecopia, GradientAI, Guardhog, Harbor.ai, Honcho, Neural Metrics, Pinpoint Predictive, Relay, and TrustLayer

For traction, 18 member corporations will work closely with the startups to establish proof of concepts and partnerships. For talent acquisition, startups will be invited to present at the InsurTech Matchmaking Expo on Oct 29. For fundraising, startups will work with 17 insurance-focused corporate VCs, traditional VCs, and angel investors. The InsurTech Accelerator New York program will run for a total of six weeks, ending on November 12.

August 12 Newsletter: Raising a Unicorn InsurTech

The IPO of Lemonade (LMND) has created a fury of teenage Robinhood traders snapping up the stock. It is thought-provoking how a simple ticker symbol has the power to make InsurTech a household term.

Looking back to when it all began in 2015, the story of how to develop and raise an InsurTech unicorn has the power to move the industry forward.

Did you know that:

~ On average, it has taken (5) funding rounds to become a unicorn.

~ The oldest InsurTech unicorn is Policy Bazaar, founded in 2008

~ 2015 was the year of the most unicorns founded (4): Hippo, Lemonade, Next, and Root

~ InsurTech unicorns have raised nearly $1B of equity since the onset of the pandemic.

Curious about the stories behind the InsurTech unicorns? Join us for our joint event with ITC and DIA on “How to Become an InsurTech Unicorn” and hear from the InsurTech founders.

Registration Today (complimentary)

________________________________________

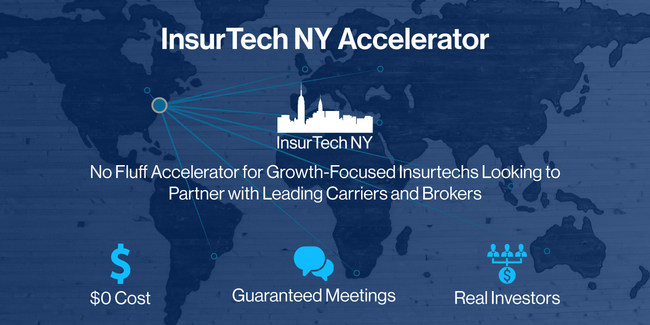

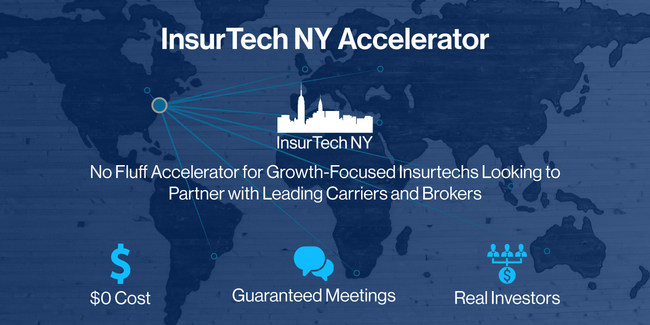

Last Chance to Apply: InsurTech NY Accelerator Program

Our application window for the accelerator program closes on Monday, August 17th.

The program is 100% virtual, no-cost, compressed to 12 days (over six weeks), and open to Growth-stage startups (Seed+ to Series B) worldwide. We have 25+ carriers / brokers and 20+ InsurTech-focused VCs / CVCs participating.

We focus on:

- Partnerships with carriers & brokers – The majority of the program time

- Talent acquisition – Meet your next hire for hard to find roles

- Fundraising – Connect with Series A / B / C Investors

We are especially interested in:

- Digital distribution for commercial P&C, surety, & specialty lines (e.g., MGAs, MGUs, Brokers)

- Capabilities to accelerate or automate underwriting

- Productivity and distribution capabilities agents and wholesale brokers

Apply here or schedule a call with us to learn more about the program here.

________________________________________

Upcoming NY Area Events and Programs

Core Systems Evolution – InsurTech and Legacy Integration (save 30% code embedded)

Aug 27 | 1:00 PM – 2:45 PM Content + 2:45 PM – 5:00 PM Networking | Fully Virtual

– 2 Panels, 2 Ted Talks, 8 InsurTech Influencers, Networking Included

– Featuring: CIO of State Auto, CIO of Tokio Marine and CDO of Nationwide

How to Become an InsurTech Unicorn (complimentary)

Sep 17 | 10:00 AM – 11:30 AM ET | Fully Virtual

– Featuring: Assaf Wand, CEO of HIppo

________________________________________

InsurTech NY Sponsors

Thank you to our sponsors for supporting the community: ClarionDoor, EIS, Guidewire, EY, and Microsoft

________________________________________

InsurTech New York Area Deals and Opportunities

Discover a curated mix of late July and early August insurance financings, exits, partnerships, and opportunities in the New York area.

CalypsoAI ($13M Raised, Paladin Capital): Multi-Line: a platform to test the performance, reliability, and security of artificial intelligence software.

The Sure Shot Entrepreneur (Podcast Launch): Hear an episode on Gokul Rajaram’s search for founder-market-fit and resourceful entrepreneurs lead to 100+ angel investments.

Primetime Partners (VC Fund Launch): $31M early-stage venture firm focused on investments that are improving the quality of life for older adults and aging.

________________________________________

Looking for Feedback on this Newsletter

We want to hear from you. What do you like in this newsletter, what don’t you like, and what would you want to see. Simply hit reply or email us at contact@insurtechny.com and tell us your opinion so we can make it better.

Best,

David, Tony, and Brett

InsurTech NY Team

InsurTech NY Opens Applications for October Cohort

This article was first published in July 2020. for up to date information regarding the InsurTech NY Accelerator, click here.

NEW YORK, July 21, 2020 — InsurTech NY, the largest InsurTech community in the New York metro area, announced today that it will be accepting applications for its growth-stage InsurTech accelerator.

The application window will be open from July 21 to August 17 and applications will be accepted through the InsurTech NY website. The program will focus on growth-stage startups that have existing customers and range in funding stage between Seed and Series B. It will be open to InsurTechs around the world.

“The InsurTech NY accelerator will focus on the critical moment in time for startups when they are crossing the chasm,” said David Gritz, InsurTech NY Managing Director. “Many InsurTechs are able to build a product and get their initial customers; however, the true test is how to scale their business. Our program is about helping InsurTechs to get to scale.”

The accelerator will focus on three areas necessary for InsurTechs to scale: market traction, talent acquisition, and raising funds. The program will provide access to insurance carriers and brokers looking to deploy new technologies and provide financial backing to digital managing general agencies (MGAs).

“The New York ecosystem has all the requisite infrastructure to lead the next wave of digital transformation in insurance,” said Erik Matson, CEO of Transverse Insurance. “We look forward to working with the accelerator to support the next crop of digital MGAs and transformative InsurTech solutions.”

The program will feature more than 15 insurance carriers and broker members including Arch Capital, Flagship Insurance, Greenlight Re, Nassau, Nationwide, Lincoln Financial Group, Gallagher, Newton Insurance, Swiss Re, Transverse, Sompo, and Pacific Life. The October cohort will run virtually for twelve days over a six week period. InsurTechs can apply at insurtechny.com/accelerator.

June 29 Newsletter: The ecosystem approach to economic resilience

When the cover of Wired Magazine is a story about insurance, you know the industry is changing. The Wired cover story told the tale of Nathan Wolfe, a West African born virologist who built a startup to solve one problem, insurance for pandemics. Nathan partnered with an American broker and German reinsurer to launch his first policy in 2018. There was only one problem:

“As far as I know, nobody bought the policy,” said Nathan in the interview.

Nathan’s story highlights the age-old startup problem of product-market fit. From the InsurTech NY vantage point, we have the opportunity to observe startups in every stage from idea to Pre-IPO and realized that it takes a village to grow a startup from the first customer to profitability.

That is why we decided to launch the first InsurTech-only growth-stage accelerator in NYC. So far, 12 carriers and brokers have joined our program and applications to growth-stage InsurTechs will open late July for our first cohort in October. Stay tuned.

________________________________________

Spotlight: Core Systems Evolution: InsurTech and Legacy Integration

The first step for any corporation to be ready to work with InsurTechs is getting its core system modernized and ready for legacy integration. The challenge in starting transformation projects is that they are high-risk because most projects are mission-critical and have no redundancy. Insurers cannot do without their policy administration, billing, or claims systems for even a few hours. Learn the stories behind the transformations at State Auto, Nationwide, and Tokio Marine and network with startups that can help your core.

Register on Evenbrite.

________________________________________

Upcoming NY Area Events and Programs

July 15 | 10:00 AM – 11:30 AM ET | Fully Virtual

– Featuring NY DFS Executive Deputy Superintendent of Insurance

Core Systems Evolution – InsurTech and Legacy Integration

Aug 27 | 1:00 PM – 2:45 PM Content + 2:45 PM – 5:00 PM Networking | Fully Virtual

– 2 Panels, 2 Ted Talks, 8 InsurTech Influencers

– Featuring: CIO of State Auto and CIO of Tokio Marine

________________________________________

InsurTech NY Sponsors

Thank you to our sponsors for supporting the community: EIS, clariondoor, Guidewire, and BobTrak.

________________________________________

InsurTech New York Area Deals and Opportunities

A curated mix of May and June insurance financings, exits, partnerships, and opportunities in the New York area.

Wired Magazine Cover: We Can Protect the Economy from Pandemics. Why Didn’t We?

Oscar Health ($225M Raised, Alphabet): Health Lines: Direct-to-consumer health insurer

Spruce ($29M Raised, Scale Venture Partners): Title Lines: Online title and closing platform for mortgage lenders and real estate investors.

Clara Insurance ($5.5M Raised, Two Sigma Ventures): Benefits Lines: Supplemental health benefits platform with integrated claims technology.

Pie Insurance ($127M Raised, Gallatin Point Capital): Workers Comp Lines: Digital MGA providing workers compensation insurance to SMBs

Clyde ($14M Raised, Spark Capital): Personal Lines: Extended warranty platform for eCommerce businesses to increase order value

Hyperscience ($60M Raised, Bessemer Ventures): Multi-Line: Automation solution built to streamline enterprise processes and eliminate data entry.

Planck ($16M Raised, Team8 Capital): Commercial P&C Lines: AI-based data platform for insurance underwriting.

Axio Global (Undisclosed Raise, IA Capital): Cyber Lines: Risk management platform to help organizations understand cybersecurity exposure and make data-driven decisions.

________________________________________

Want to mentor growth-stage startups?

InsurTech NY is currently seeking experienced insurance leaders and successful InsurTech founders to join the mentorship component of our accelerator. If you are interested, please send a note to contact@insurtechny.com.

Best,

David, Tony, and Brett

InsurTech NY Team

InsurTech NY Announces First NYC InsurTech Accelerator

InsurTech NY Announces First NYC InsurTech Accelerator

NEW YORK, NY, June 24, 2020 — InsurTech NY, the largest InsurTech community in the New York metro area, announced today the upcoming launch of the InsurTech NY Accelerator, the first dedicated NYC-based accelerator for growth-stage InsurTech startups.

Scheduled to begin operations in October, the accelerator will start taking applications from growth-stage startups that have revenue and customers in late July.

“Growth stage InsurTechs will benefit from a dedicated advocate to help them navigate the partnership process with insurance carriers and brokers,” said David Gritz, InsurTech NY Managing Director. “Our community has been there to support the needs of the InsurTech ecosystem. We are pleased to introduce a platform for those that want to rapidly expand their business through our partners.”

InsurTech NY Accelerator will focus on the three things that matter most to growth-stage InsurTechs: traction, talent, and financing. The program will provide access to insurance carriers and brokers looking to deploy new technologies and provide financial backing to digital managing general agencies (MGAs).

“New York is known as the home to three InsurTech unicorns: Lemonade, Oscar, and Policy Genius,” said Paul Tyler, CMO of Nassau Re. “We hope to use the InsurTech NY platform to find and support the next set of InsurTech unicorns.”

The initial carriers and brokers in the program include Arch Capital, Flagship Insurance, Greenlight Re, Nassau Re, Nationwide, Swiss Re, Transverse Insurance, and five others to be announced. Participating corporations will rotate in hosting InsurTechs during the program. The first cohort will run for six weeks, and InsurTech startups will not give up equity to be part of the program.

About InsurTech NY

InsurTech NY supports the insurance innovation community in the New York metro area. InsurTech NY brings together carriers, brokers, investors, and InsurTech startups via bi-monthly programs. InsurTech NY’s mission is to drive talent to insurance, make regulation innovation-friendly, attract InsurTechs to the New York metro area, and improve access to investment. See more at www.insurtechny.com/accelerator or follow us on LinkedIn (www.linkedin.com/company/insurtechny).

Contact: David Gritz

press@insurtechny.com

212-634-9516

May 10 Newsletter: Data and Analytics During a Pandemic

Second-quarter marked a historic shift in society. The price of data exceeded the price of oil. Oil futures contracts went negative on April 20th while the Nasdaq broke even for the year on May 8th.

This shift has manifested as an ever-present stream of talking points on national news. The media, which typically is stylized as narrative, now begins stories with data points like the number of new infections, the number of unemployed, and the ten-year treasury rate.

In a world where data is the new currency, insurers need to have a plan to harness the data they already have, to augment their data from third parties, and to apply powerful analytics tools for prediction. To help guide you with your plan, InsurTech NY is hosting a virtual event on May 21st covering how insurers can use data and analytics to improve underwriting and claims. See the full details below.

________________________________________

Upcoming NY Area Events and Programs

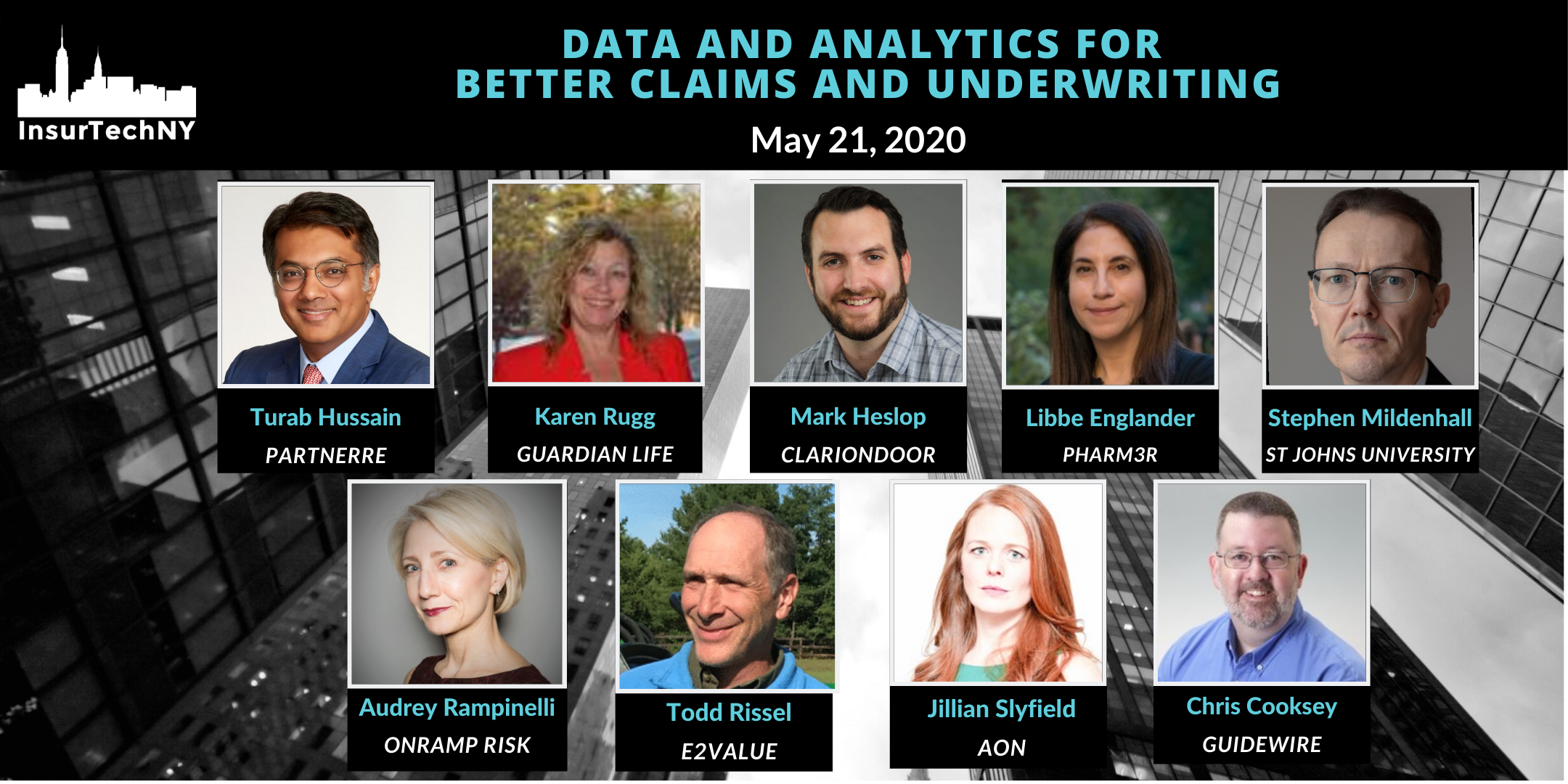

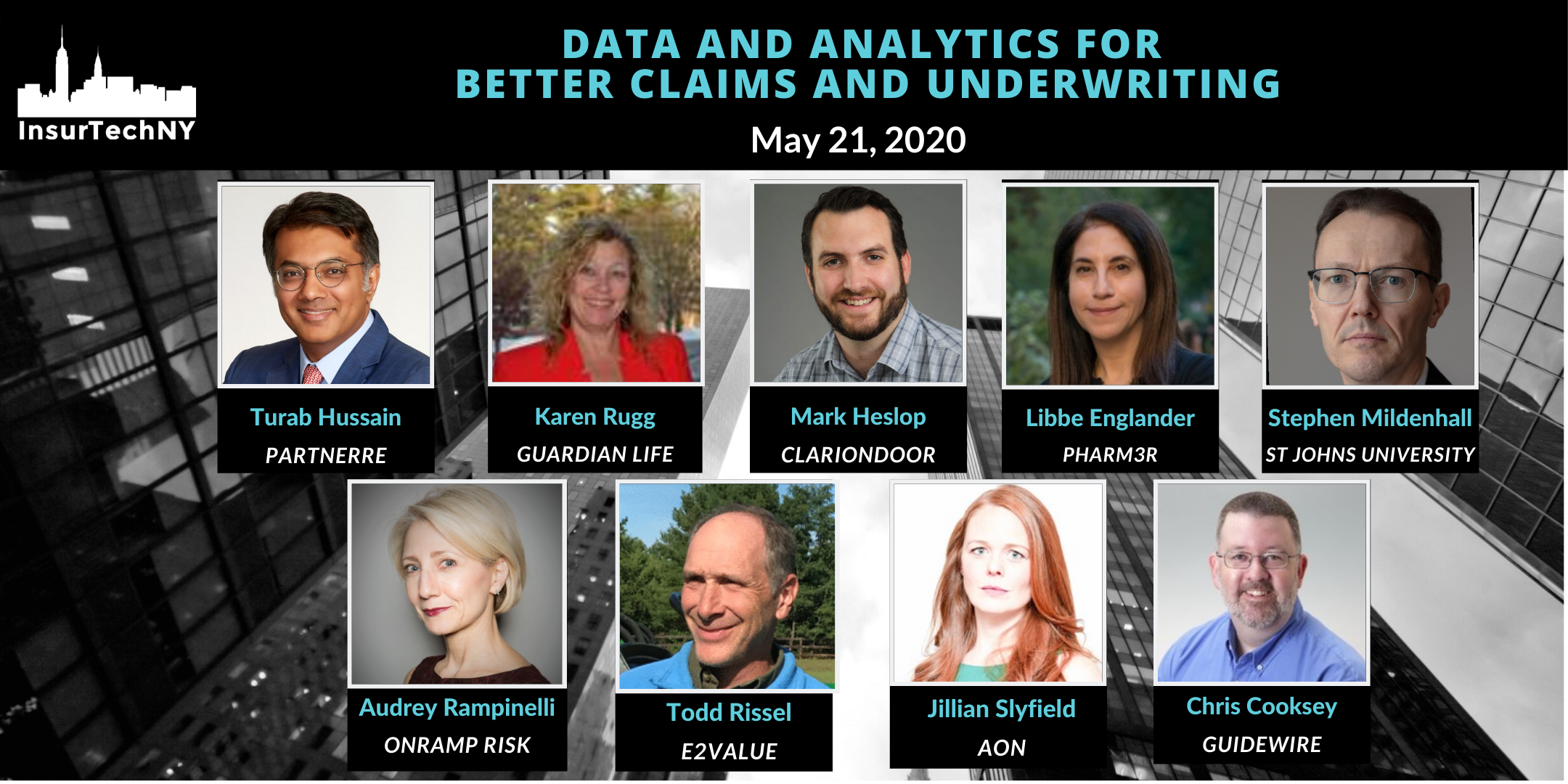

Data and Analytics for Better Claims and Underwriting (1/3 Off Tickets)

May 21 | 4:30 PM – 6:00 PM Content + 12PM – 6PM Networking | Fully Virtual

– 2 Panels, 2 Ted Talks, 8 InsurTech Influencers

– Featuring: Chief Actuary at PartnerRe and Digital Economy Practice Leader at Aon

Risk Management in the Age of COVID (1/3 Off Tickets)

May 13 | 1:00 PM – 3:35 PM | Fully Virtual

– 3 Panels, 2 Ted Talks

– Network with more than 120 senior risk management professionals already registered

InsurTech Hartford Innovation Challenge

Applications close May 15 | Challenges for InsurTech, cyber risk, and self-service

________________________________________

InsurTech NY Sponsors

Thank you to our sponsors for supporting the community: evolvor, clariondoor, Guidewire, and e2Value.

________________________________________

InsurTech New York Area Deals and Opportunities

A curated mix of late Apr and May insurance financings, exits, partnerships, and opportunities in the New York area.

White Ops (Undisclosed Raise, Goldman Sachs): Multi-line: Bot mitigation and fraud protection to protect web-based platforms.

Nexar ($52M Raised, Corner Ventures): Multi-line: Computer vision-based software company building a safe-driving network.

Covered by SAGE ($6M Raised, NFX): P&C Lines: Agency platform that provides quoting, analytics, pipeline management, and a CRM system.

Biohacking Congress (Apply to Present): Applications open for 10 min startup pitches to VCs interested in HealthTech.

________________________________________

Join the Conversation on Social

Join us in between newsletters on social media.

LinkedIn: linkedin.com/company/insurtechny

Twitter: twitter.com/InsurTechNY

Meetup: meetup.com/insurtechNewYork

Best,

David, Tony, and Brett

InsurTech NY Team

April 26 Newsletter: Making Virtual Experience Work

This article was published in May 2020. For information regarding current InsurTech NY events, please click here.

The great transition to working from home has opened up a new world of virtual experiences and virtual etiquette. Demand for tops has outpaced bottoms as dress shirts and sweatpants become a new fashion statement.

However, with all of the changes occurring, the need for human connection remains. Whether you are stuck in a 600 square foot apartment in Manhattan or you were able to escape to your suburban second home with a yard in Connecticut, you still need to keep in contact with your team and look for technology solutions outside your VPN.

At InsurTech NY, we had the opportunity to transition our 500-person Spring Conference to virtual. Making the transition required us to think about every aspect of the experience from the 80+ speakers and judges. This process forced us to go through trial and error quickly. Learn more by reading the Full Virtual Guide

Now that we have made the switch to virtual you will be able to join us every other month for virtual experiences that mirror our late afternoon programs. Our next event will be on Data and Analytics on May 21st.

________________________________________

Upcoming NY Area Events and Programs

Data and Analytics for Better Claims and Underwriting

May 21 | 4:30 PM – 6:00 PM Content + 12PM – 6PM Networking | 100% Virtual

– 2 Panels, 2 Ted Talks, 8 InsurTech Influencers

– Featuring: Chief Actuary at PartnerRe and Digital Economy Practice Leader at Aon

InsurTech Hartford Innovation Challenge

Apply Now to May 15 | Challenges for InsurTech, cyber risk, and self-service

________________________________________

Spotlight: Looking to Transition Roles? We are Here to Help.

In turbulent times, it is important to be positioned to transition. InsurTech NY has partnered with Precision Research Group to offer no-cost webinars to help those planning for transition or looking for new roles.

Learn the proprietary secrets of a Fortune 100 recruiter who has helped thousands of candidates deliver compelling messages that accelerate and actualize their career goals. This interactive session will present practical tools and techniques that will help you Network with Confidence by (1) Identifying your professional value, (2) Communicating your value on a resume, LinkedIn profile and/or in networking and interviewing situations, and (3) Competing and negotiating with confidence.

Join one of the available sessions at Register via Calendly. Sessions available Apr 30, May 1, and May 5.

________________________________________

InsurTech NY Sponsors

Thank you to our sponsors for supporting the community: Eversheds Sutherland, clariondoor, Locke Lord, E2Value and EIS Group

________________________________________

InsurTech New York Area Deals and Opportunities

A curated mix of late Mar and Apr insurance financings, exits, partnerships, and opportunities in the New York area.

InsPro Technologies ($12M Acquisition by Majesco): Life and Annuity Lines. Policy administration and marketing system that supports group and individual business lines.

Hi Marley ($8M Raised, True Ventures) Multi-line. AI-enabled texting platform for the insurance ecosystem.

Bodhala ($10M Raised, Edison Partners) Multi-line: Legal spend management platform built for legal teams to optimize and understand their outside counsel spend

________________________________________

Find the best qualified InsurTech innovators

Struggling to find the right people to fill your Insurance or InsurTech roles? We are here to help. If you would like to talk with our team to help you fill open roles, please reach out at contact@insurtechny.com.

Best,

David, Tony, and Brett

InsurTech NY Team

- 1

- 2